PCG Insights: Relative Value in Private Debt

Market performance data can help demystify the wider asset class and shine a light on where relative value might best be found both in the context of the domestic versus offshore market and more specifically within the domestic market.

The New Zealand Private Debt market has emerged over the past 18 months as a viable capital market funding source for NZ businesses. Whilst the domestic ecosystem remains small, new and unfamiliar to many domestic investors, there is a wealth of information and context available from offshore jurisdictions which can help borrowers and investors to navigate the path ahead in NZ.

Private debt is still considered to be a somewhat homogeneous asset class in the eyes of most NZ investors.

Global, regional or domestic private debt markets, and the differences in risk and reward between each, are only now beginning to come into some degree of focus for domestic NZ investors, many of whom are looking to access the asset class for the first time.

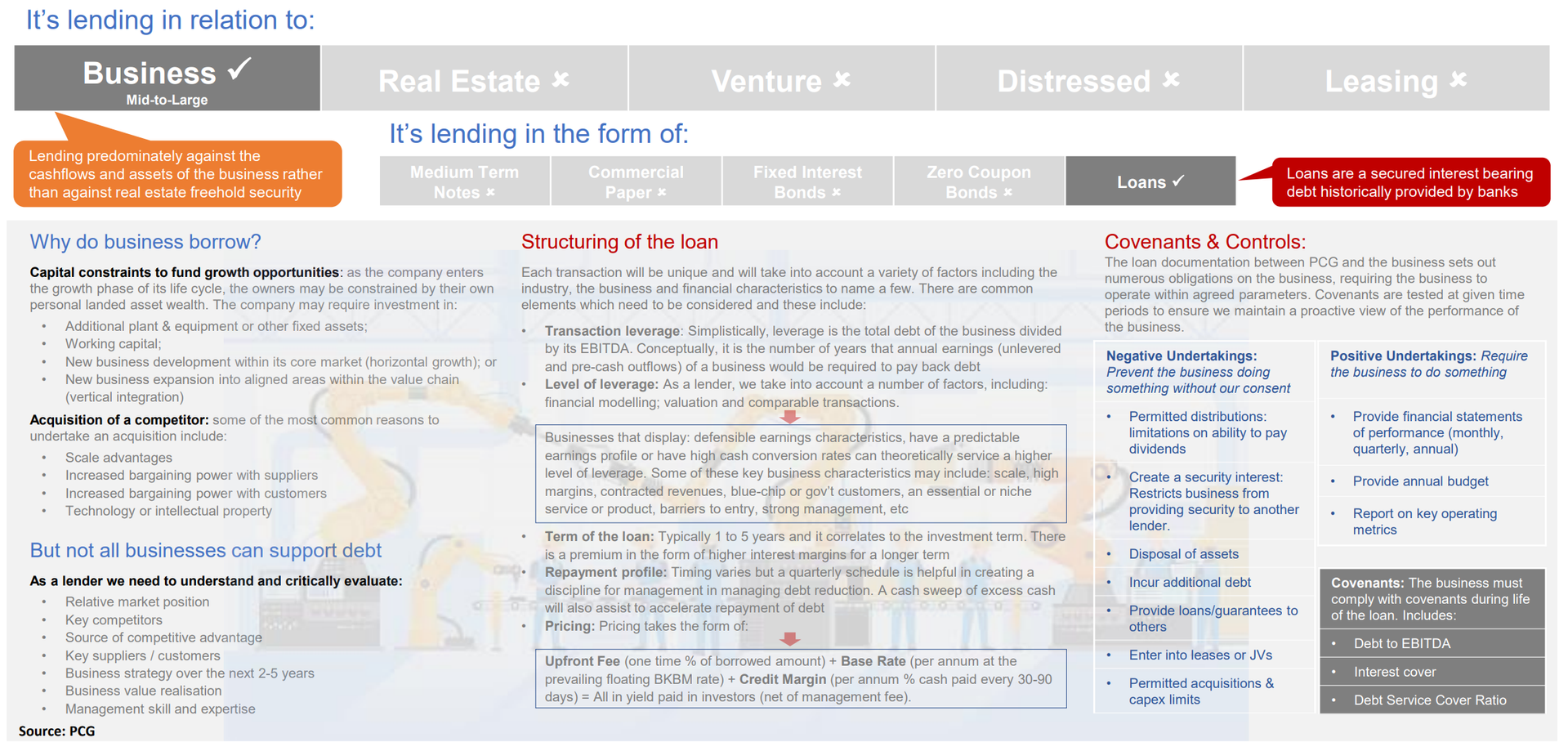

The more fundamental issues surrounding i) investors’ portfolio allocation strategies which are largely focused on a debate between determining an appropriate weighting between public market fixed interest and alternative market private credit and ii) borrower considerations when choosing between traditional bank loans versus a fund sourced private debt deal, masks a far more nuanced analysis which surrounds manager strategies, expertise and the nature of financing each provides.

This analysis additionally draws attention to both the markedly different competitive environments between jurisdictions which can result in a wide range of risk adjusted return profiles and to the divergent approaches adopted by managers all of which has the potential to deliver asset portfolios with a range of underlying performance and risk characteristics.

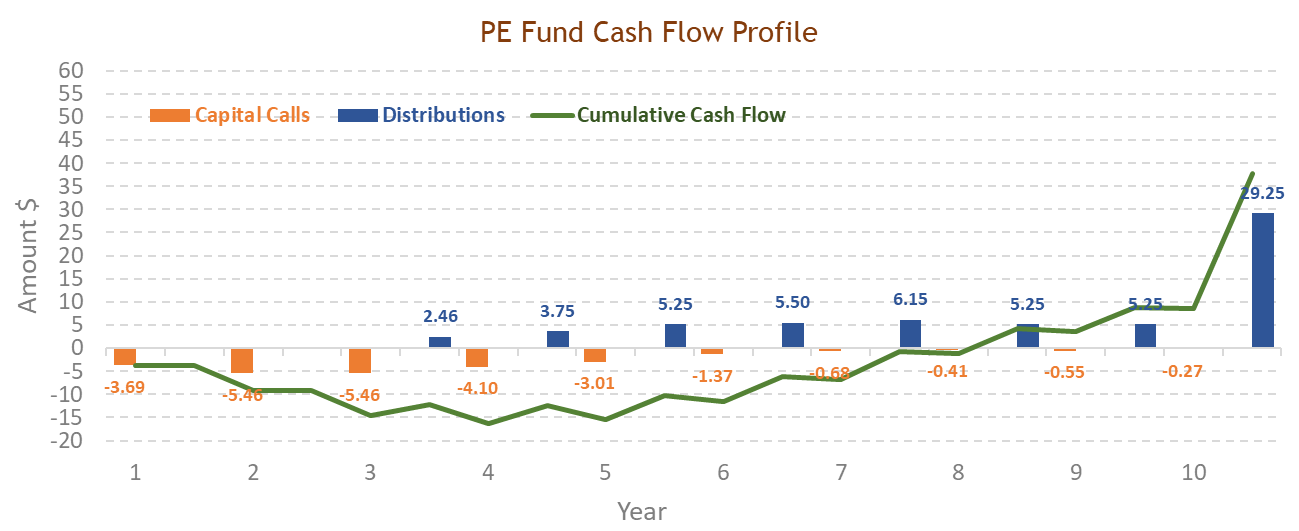

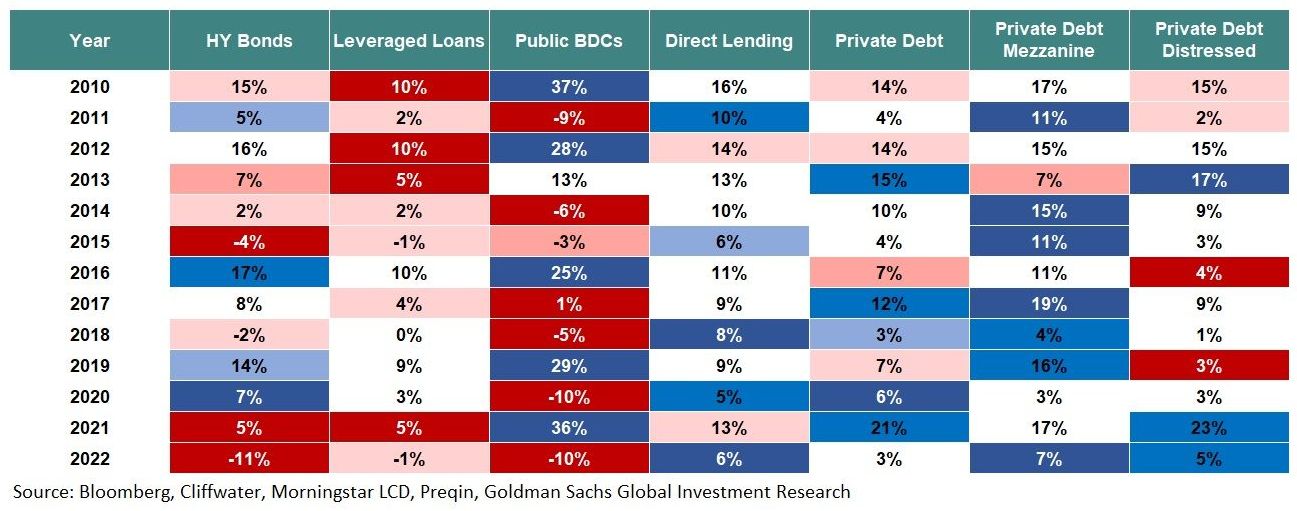

In general and for yield oriented strategies and investments, it is widely understood that private market assets have consistently outperformed public market assets (refer table below). Within private markets, yield assets specifically, direct lending and private debt (support of sponsor deals) have outperformed leverage loan participation based strategies.

Domestic v offshore markets

Commentators and fund managers seem to be fixated on defining private debt’s positive relative returns or perhaps more appropriately the favourable risk adjusted returns it generates. Globally, and as witnessed by the scale of today’s private credit market (which totals some USD1.5t), private debt’s place as a yield oriented complement to fixed income and cash is now universally accepted.

What is therefore more interesting for investors to understand is how the risk reward of investing in private debt might best be measured between various jurisdictions.

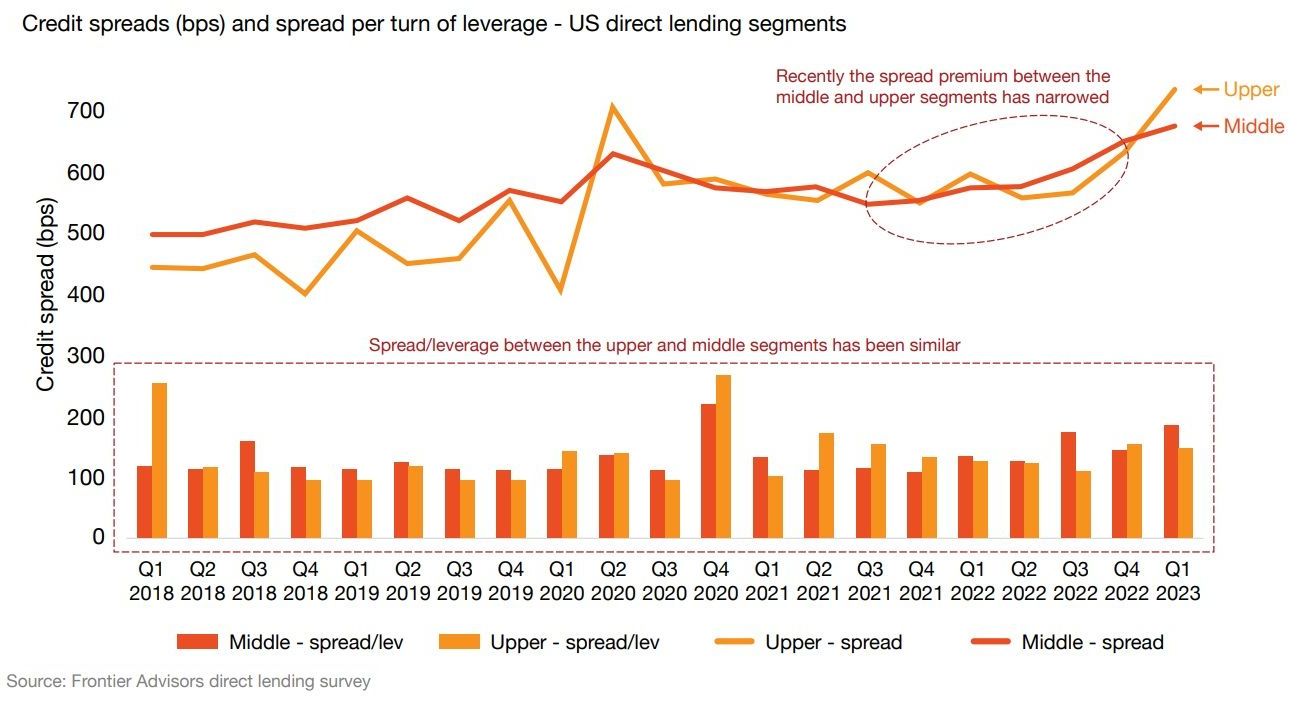

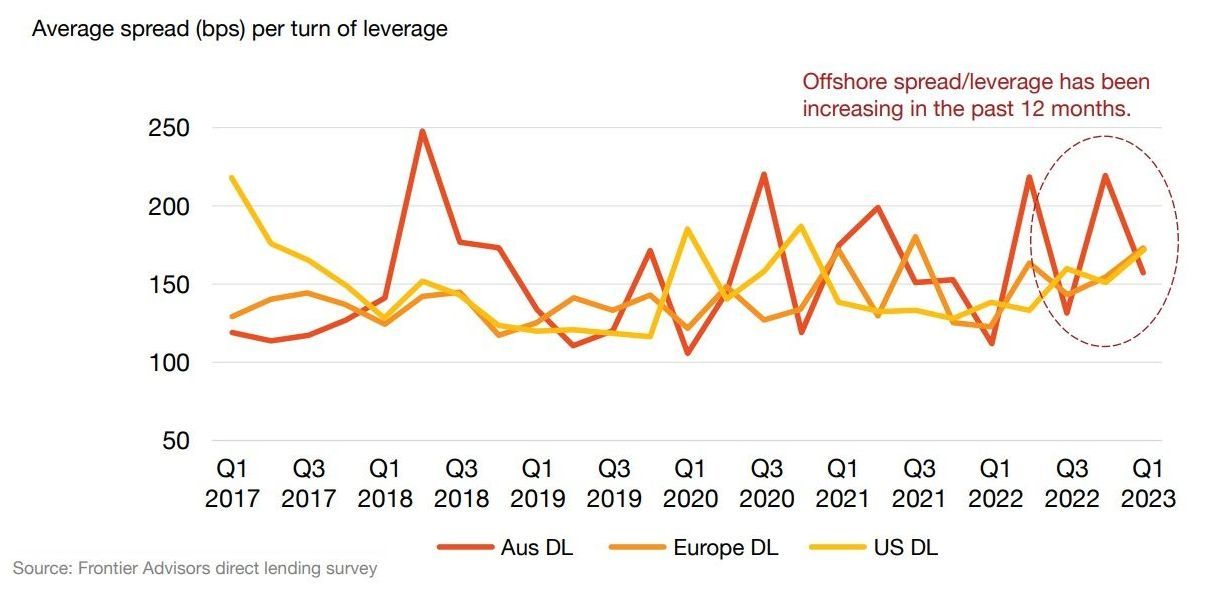

A recent report by Frontier Advisors (an investment consultant) suggests that regardless of the size of a given investment or underlying business, the level of credit spread generated is broadly comparable (Chart 1, below). Moreover, the measure of risk:reward, that is the credit spread per unit of leverage, is also broadly uniform and tends to move within a relatively narrow range over the cycle, even though this is on somewhat of an upward trend at present (Chart 2, below).

Intuitively, this makes sense as it is often the level of leverage in a given transaction which adjusts to reflect market conditions and economic performance more generally.

Chart 1

Chart 2

What is interesting is that with the advent of the NZ private debt market, we can now look to identify the premium available for investing in the NZ market. The presence of a premium might be viewed as the rate which is required to attract an investor into a new jurisdiction or for a domestic investor allocating to the domestic market relative to the larger market offshore.

At PCG, we consider the presence of a premium to be more fundamentally something driven by domestic supply and demand. NZ is populated with SMEs, historically serviced by a concentrated banking market which is now going through a significant change in its capital adequacy framework and a private debt market with limited domestic capacity which is simply either too far away geographically from the established markets of US, Europe (and even Australia) or simply doesn’t fit with the scale issues associated with investing multi-billion dollar funds.

Whilst data points in the domestic market are still limited, our analysis suggests credit spreads in the domestic NZ market range between 600-900 points over the floating rate basis and with modest levels of asset leverage which are significantly below those provided offshore. This translates to a range in return, per unit of leverage, between 200-300 points. These ranges are significantly above those available offshore and, importantly, are all NZD denominated.

Moreover, the domestic NZ market removes the significant issue of currency risk associated with all investment offshore. We consider the discount in returns from investing offshore, and the resulting increased risk of return variance from currency, to be a major disadvantage.

Within the domestic market

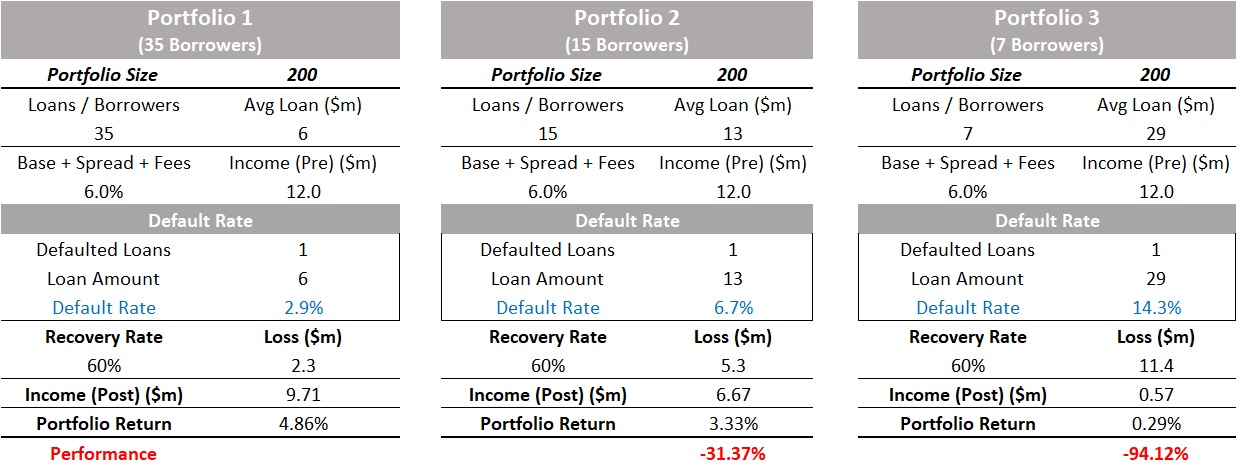

We contend that investors should aim to partner with managers that have the ability to be a lead or sole lender.

Credit spreads are consistently higher for managers with genuine origination reach. This means sourcing proprietary deals rather than sourcing an opportunity to join someone else’s (invariably a bank’s) transaction. This factor is demonstrable across jurisdictions and vintages and is perhaps even more pronounced in markets such as NZ where managers have less expertise and experience in managing funds and in understanding the impact which comes with knowing what to look for and why.

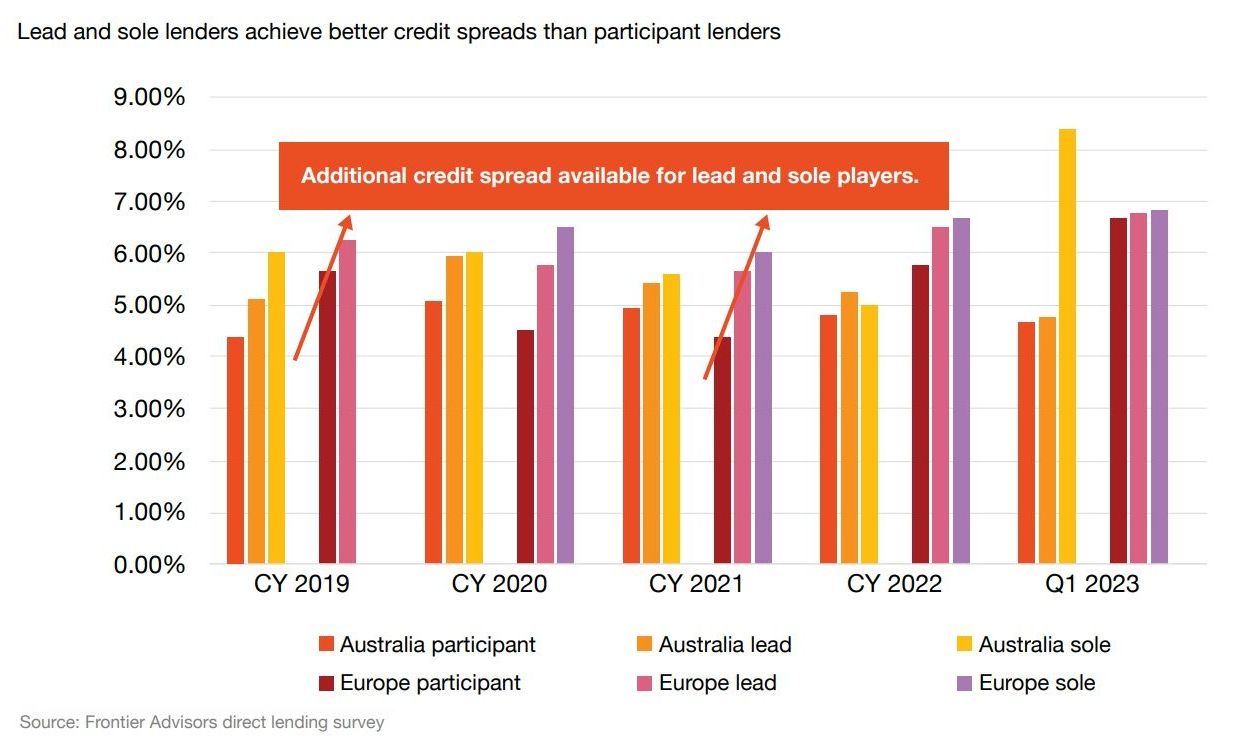

Chart 3

Chart 3 illustrates that credit spreads earned by lead and sole lenders have been stronger than those earned by lenders that are simply a participant in a transaction. While the chart shows Australian and Europe focused managers, the same pattern is observed in the US. Consequently, it is highly beneficial for investors to partner with managers that can act as lead or sole lender.

PCG’s portfolio is comprised 100% of loans which we have originated, structured and negotiated. We favour deals where we can control the relationship with management and equity and can determine how to manage the positions which comprise our portfolio rather than having to accept terms created by others who might have conflicts or other interests to protect.

This is critical in situations where an asset may under-perform. Expertise and experience in working out difficult situations talks to marriage of past examples and an ability for decisive decision making.

As the sole lender to the deals we create, we are free from the conficts which can often arise when working in a lending syndicate. We will not accept the risk that, as a participant, we can be dragged along when working with banks or other lenders with incongruent objectives. This is so much more acute an issue in markets such as those throughout Asia Pacific and Australia/New Zealand where there is no secondary market asset liquidity.

As the European market has matured, managers with genuine direct lending skill sets have carved out strong market positions and have capacity to write deals of various sizes which they can fund alone. In Australia, the market has experienced a proliferation and many of the new funds which have entered the market over the recent past have chosen to participate in deals brought to them by other lenders as their primary source of opportunity. We consider this to be a risk with inexperienced managers more generally.

In NZ, private debt managers are often managing funds for the first time. The nuance of strategy and positioning is arguably still forming and there is a sense of trial and error at play.

At PCG, our heritage and expertise is attributable to managing funds for investors over more than 20 years. We have seen the benefits of certain strategies over others and this has enabled us to optimise the positioning of our platform in the domestic market so as to maximise control, returns and origination.

We seek to avoid larger deals in the wider syndicated market where controls are diluted. Retaining covenants as early warning indicators is central to our risk management. Early action not only maximises recoveries, it enables early remedial action to be implemented and provides a contractual engagement with aligned management and equity investors.

Chart 4