PCG Insights: Loans v Bonds - Opportunity Across the Credit Spectrum

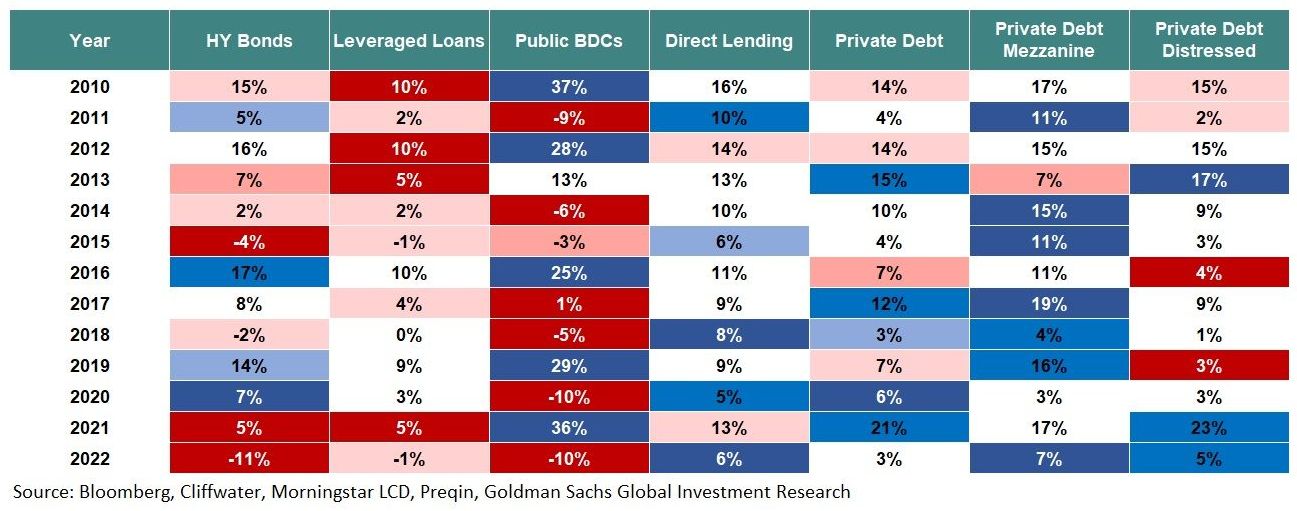

Private Debt (‘Loans’) offers a number of diversification benefits by targeting different parts of the market and borrower profiles compared with public credit (‘Bonds’).

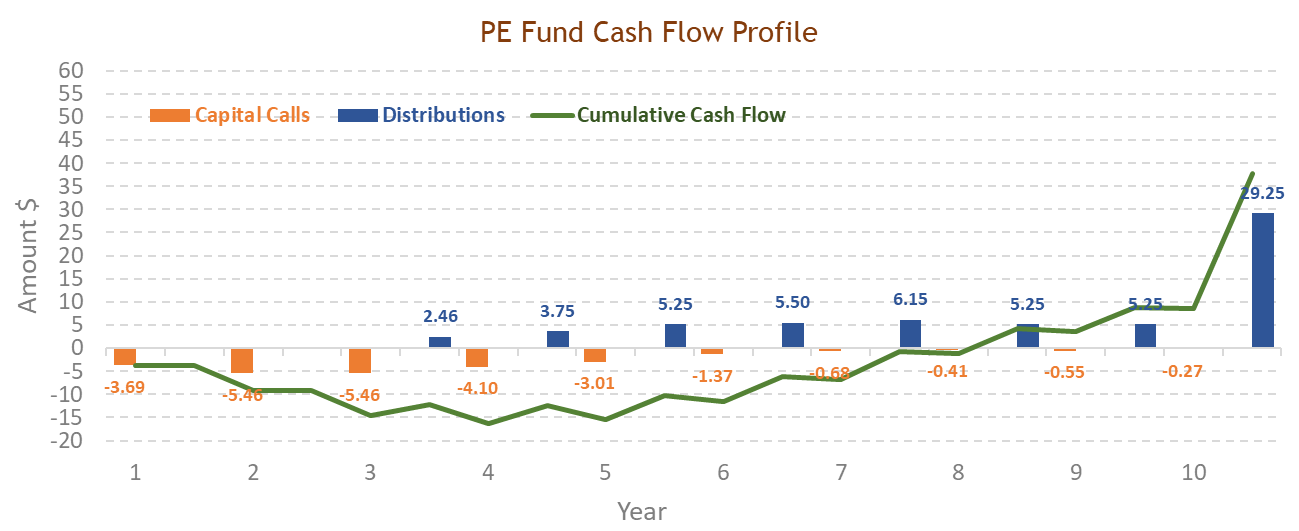

The majority of Private Debt returns are generated through income rather than capital gains and are seen as an attractive source of higher yields, compared with traditional fixed income. Investors use Private Debt as a yield-enhancer within a broader fixed income portfolio and/or a diversifier within an overall growth portfolio.

The traditional investible world is sometimes grouped into very high-level buckets: equity risk, fixed income risk and alternative risk, but these groups are broad and therefore, miss the nuances. Just like we slice and dice the equity world into many different categories; growth, value, large cap, small cap etc, there are many different types of credit income risk.

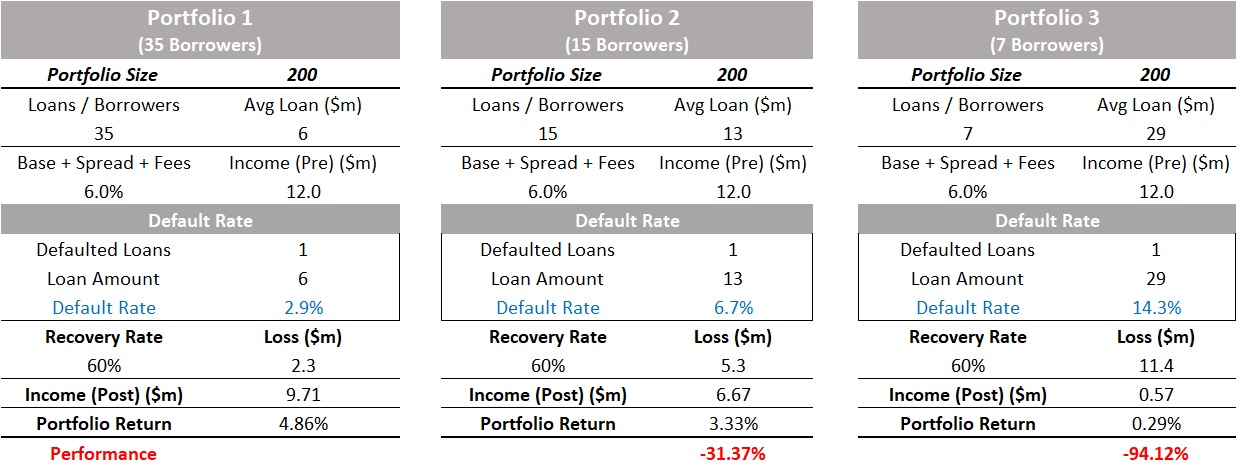

We think Loans deserve a place in an overall credit allocation. When looking for income, investors should try and find as many sources as possible. It's about diversifying that income with exposure to more than one area of the market. Diversification is so important in credit income, because of that asymmetric risk to the downside. Wherever there’s a chance to diversify into different areas to achieve return objectives, that's a really smart thing to do.

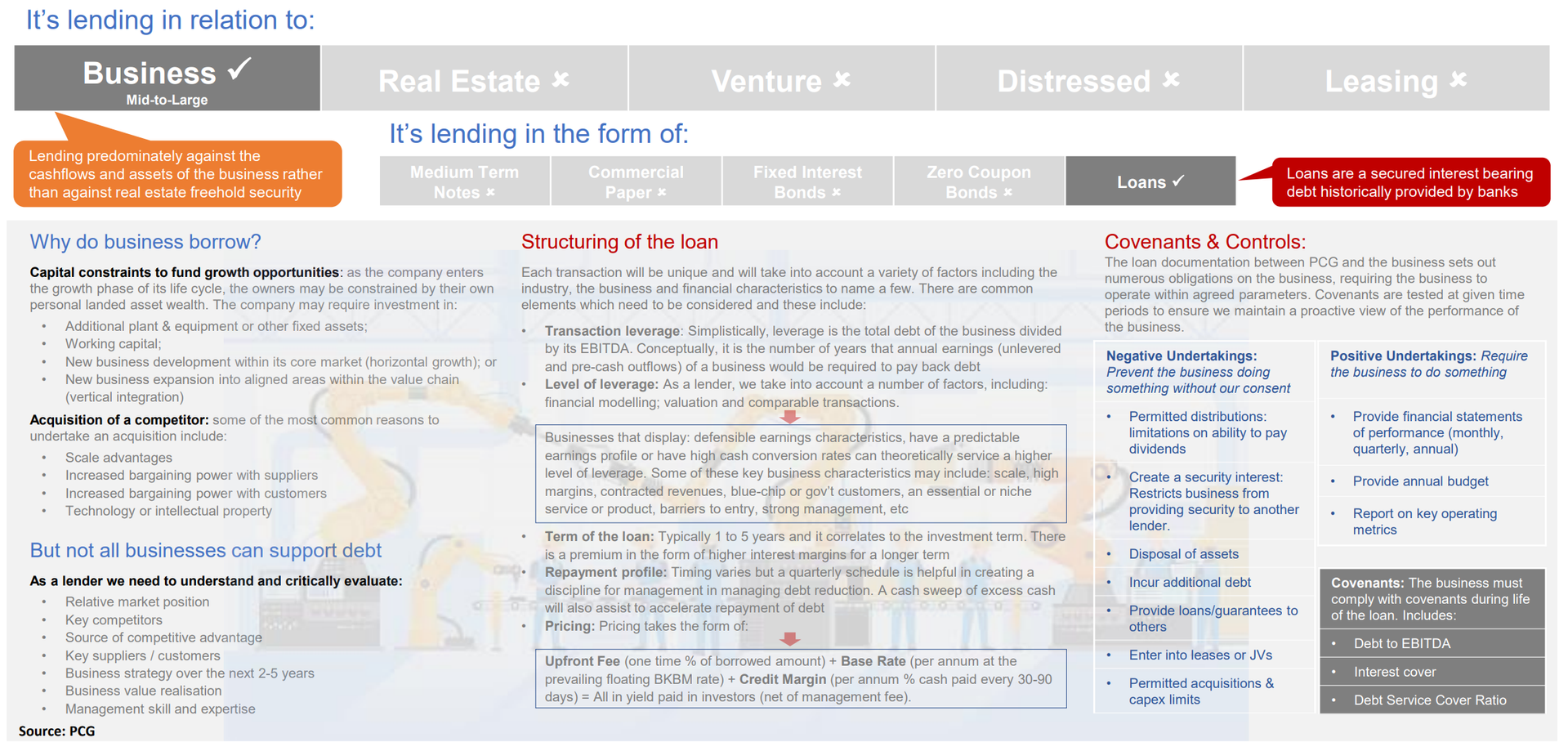

When investors think of credit, they're mostly thinking about the fixed interest market. In our view, investors should look more broadly across credit markets. Private Debt and publicly traded bonds stand at distinct ends of the credit market. Loans contain maintenance financial covenants, numerous undertakings that often entail active on-going lender involvement and amortised repayments. Bonds on the other hand, contain only incurrence covenants, offering the issuer significant flexibility, with minimal bondholder interference and bullet repayments. As such, they are treated as two separate asset classes, with different market expectations and pricing considerations.

The characteristics of Private Debt, including its defensiveness given its place in the capital structure, high risk-adjusted returns, steady income production and the natural liquidity afforded by the short-weighted average life of Loans – compared to longer-dated assets – all help position it favourably relative to bonds. Private Debt can also be a more bespoke solution, enabling greater alignment with corporate and investor goals and a better ability to positively shape the corporate sustainability practices of borrowers. The strategies are well-suited to customisation for investors — such as liability matching or targeting non-financial goals for an investment, like social impact.

The correlation between stocks and bonds over the last two years is the highest since 1995-97, placing serious strain on the 60/40 balanced approach – previously a mainstay of investment portfolios. So, investors may ask how Private Debt fits into investment portfolios? It depends on the investor’s objectives. For instance, Private Debt may be especially helpful in alleviating the pressure that a rising rate environment places on distributions in bond portfolios. Private Debt could be a complement to, or substitute for, income-oriented allocations such as high yield bonds, dividend-oriented equities, or other fixed income. Private Debt can also be used to diversify return streams within a fixed income portfolio