PCG Insights: Diversification in Private Debt

Private debt management is not so much about picking the winners, it's about avoiding losers and minimising their impact if they occur. Diversification is the key to minimising the impact of losers and can be viewed through a number of lenses. In this note, we discuss the importance of diversification by borrower number in a senior risk private debt portfolio.

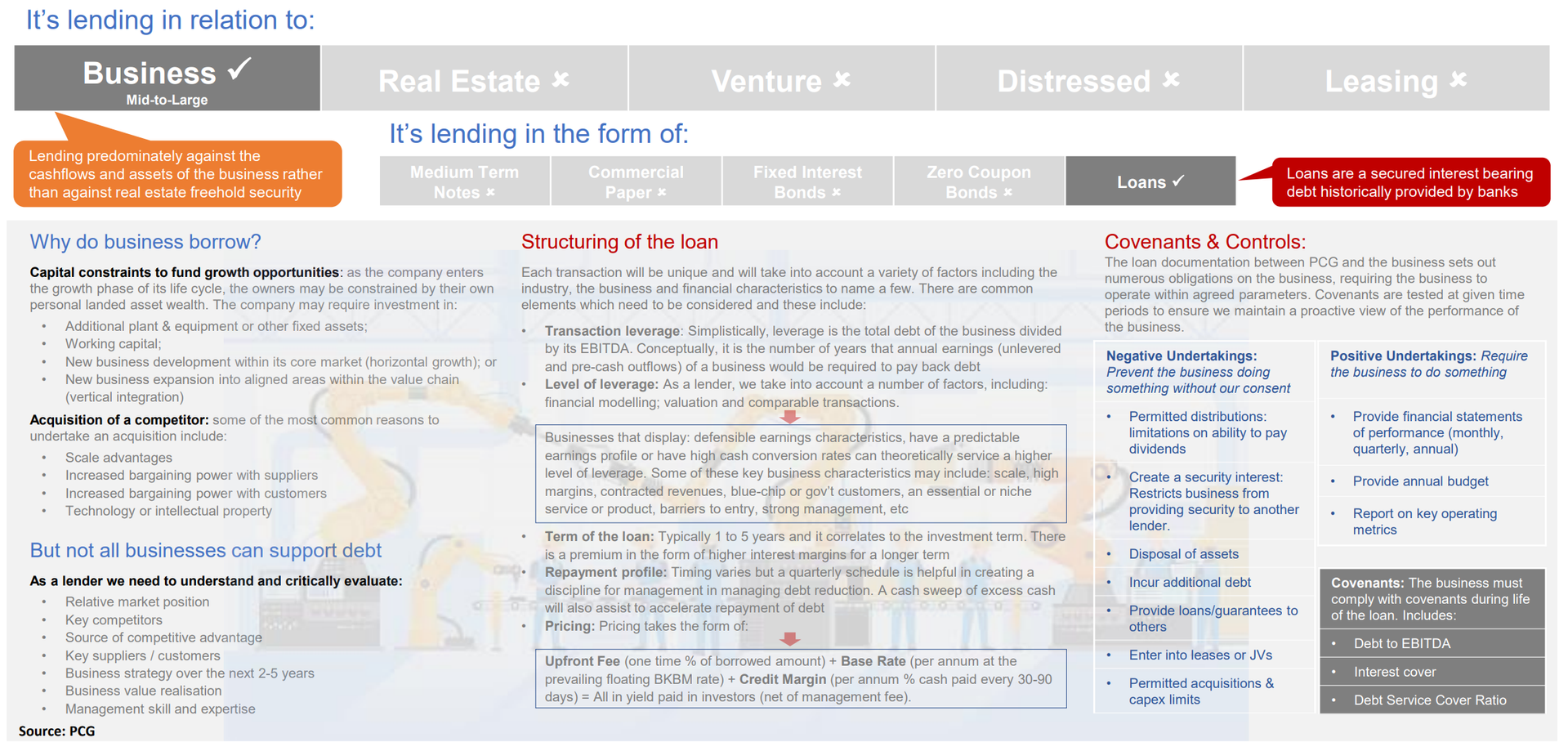

At PCG, when undertaking fundamental analysis on a potential new investment, the first question we ask ourselves is can the borrower repay us - Are we going to get all our capital back at the end of the loan term? We seek to lend money to businesses where we receive a contractual return in the form of front-end fees and interest payments. If all goes to plan, the initial capital loaned out is repaid at the end of the loan term.

Investment returns can potentially be significantly reduced by a borrower default in a concentrated senior risk portfolio. This is where the initial capital loaned out is not repaid, in full, at the end of the loan term and losses erode portfolio returns. Success in a senior risk private debt strategy is not so much about picking the winners, it's about avoiding the losers and minimising their impact if they occur. How do we avoid the losers? Through rigorous assessment of borrower credit worthiness. Credit risk analysis is critical in identifying then avoiding the losers and is only developed through years of hands-on experience.

How do we minimise the impact of losers if they occur? No matter how well a particular risk is understood, unforeseen events can occur and, depending on the severity, could lead to a borrower default. Not all defaults lead to losses but the impact of loss from default can only be minimised through diversification

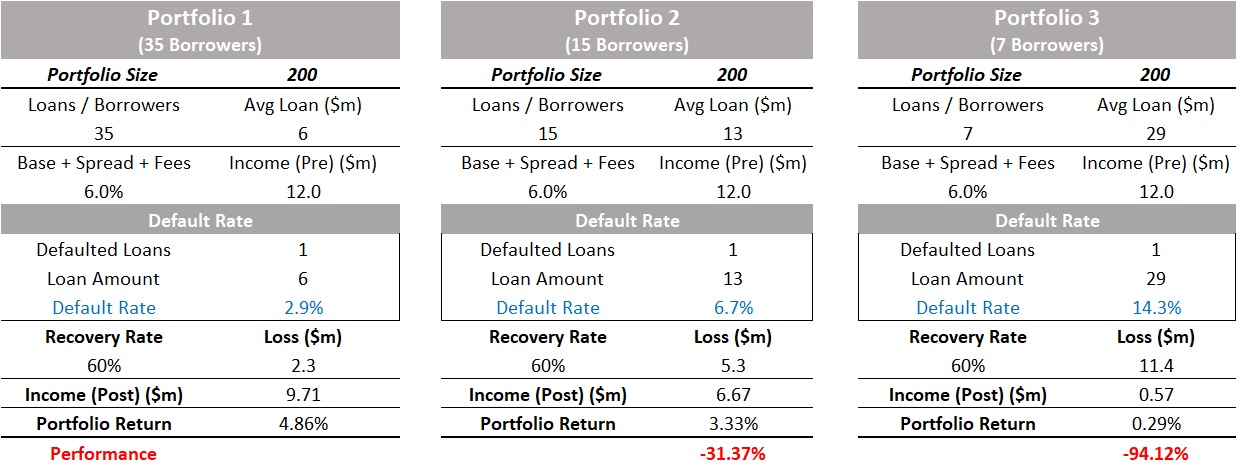

The impact of a loan default on investor returns is illustrated through a simple example. In the table above, we present three hypothetical loan portfolios. All portfolios are the same overall size and achieve the same pre-loss return. The distinguishing feature is the number of borrowers in each portfolio: 35/15/7. The risk and return dispersion, across the portfolios, can be seen through the default of one loan.

In a diversified portfolio, the return generated for investors is represented by the excess spread at the individual loan level. The excess spread is the required return above the base return plus an amount to cover any losses - that excess spread is multiplied across the portfolio. Not all loans will suffer from poor performance. In fact, the current rate of non-performing business loans in NZ is about 0.5% (RBNZ: S50 report). Recovery of the non-performing loan principal (through an enforcement of loan security), varies depending on the situation but is generally substantial. With excess spread generated on every single loan, the portfolio generates an excess return that is multiples of the loss that might occur. Diversity helps to ensure that the invested capital is protected and that investor returns are safeguarded.

The relative risk-reward between equity and credit investing is different. In public equity investing, the benefits of diversification diminish beyond a certain number of stocks. That doesn’t apply in credit because of the asymmetric risk to the downside in loans - meaning the value of the loan cannot increase the way a stock might, at maturity we will be repaid par. Conversely, equity values can rapidly diminish whereas debt downside is limited given loan security. We can make consistent returns if we invest in loans which perform but this return will be impacted if losses occur. The more concentrated the portfolio, the greater the impact of any losses.

At PCG, we think in probabilistic terms so we build and manage diversified senior risk portfolios for our investors. Loan selection is important but the stability of returns is maintained through diversification as this diminishes the potentially adverse impact of default.