Global Expertise. Local Focus

Specialists in Corporate Private Debt

Button

New Zealand’s Dynamic Credit Partner. Meeting Borrower and Investor Objectives

Specialists in Corporate Private Debt

Button

Reliable Credit Income. The Long Term Stable Yield Alternative to Fixed Interest

Specialists in Corporate Private Debt

Button

Global Expertise. Local Focus

Specialists in Corporate Private Debt

New Zealand’s Dynamic Credit Partner.

Meeting Borrower and Investor Objectives

Specialists in Corporate Private Debt

Reliable Credit Income.

The Long Term Stable Yield Alternative

to Fixed Interest

Specialists in Corporate Private Debt

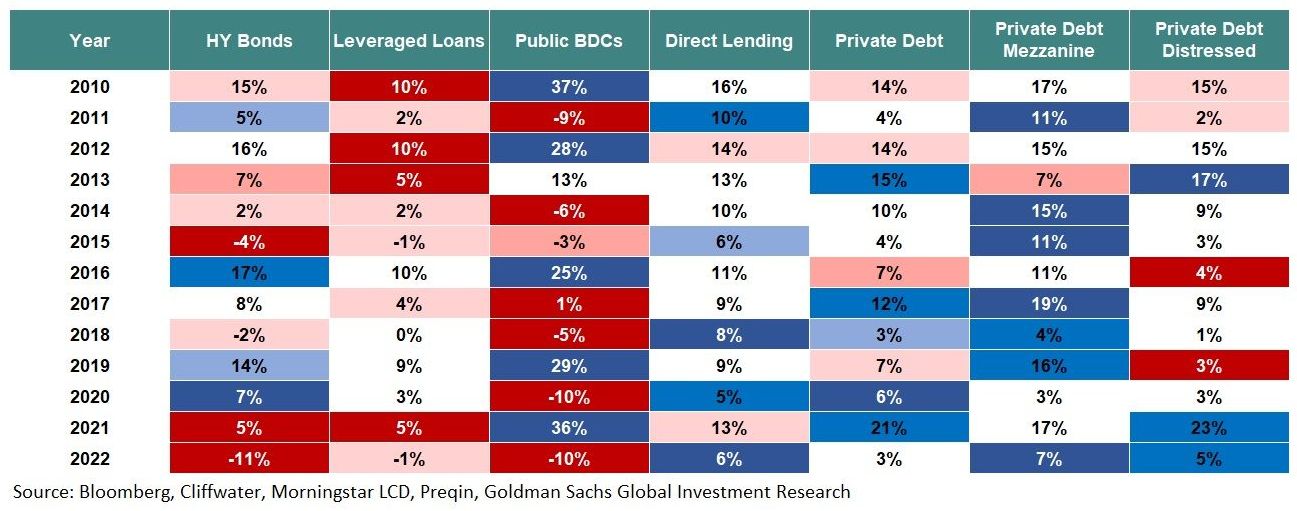

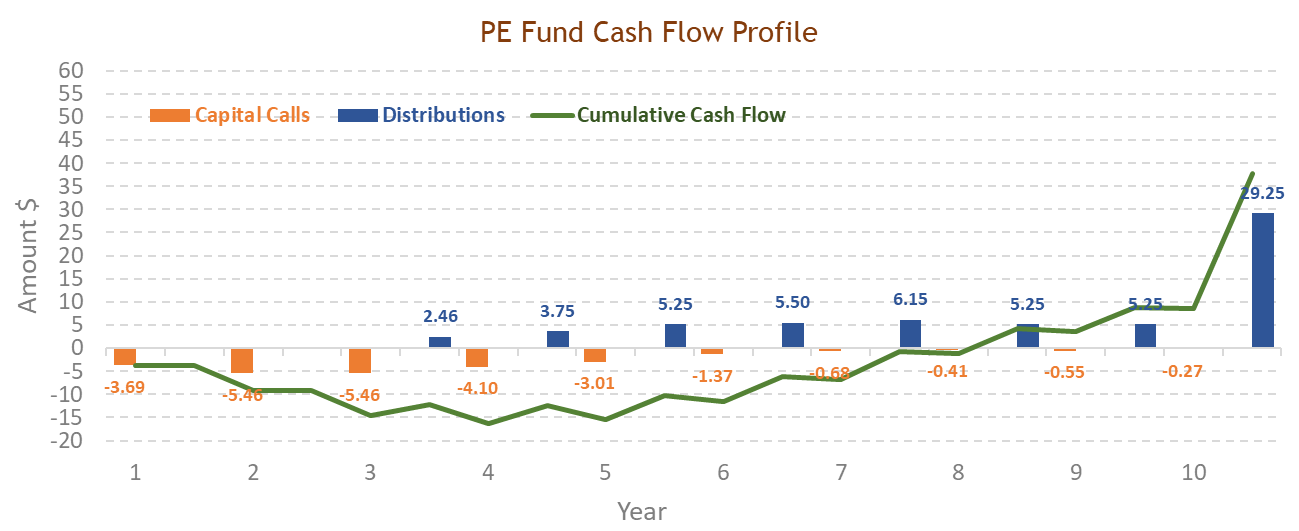

Solving Yield Allocation Challenges For Long Term Investors

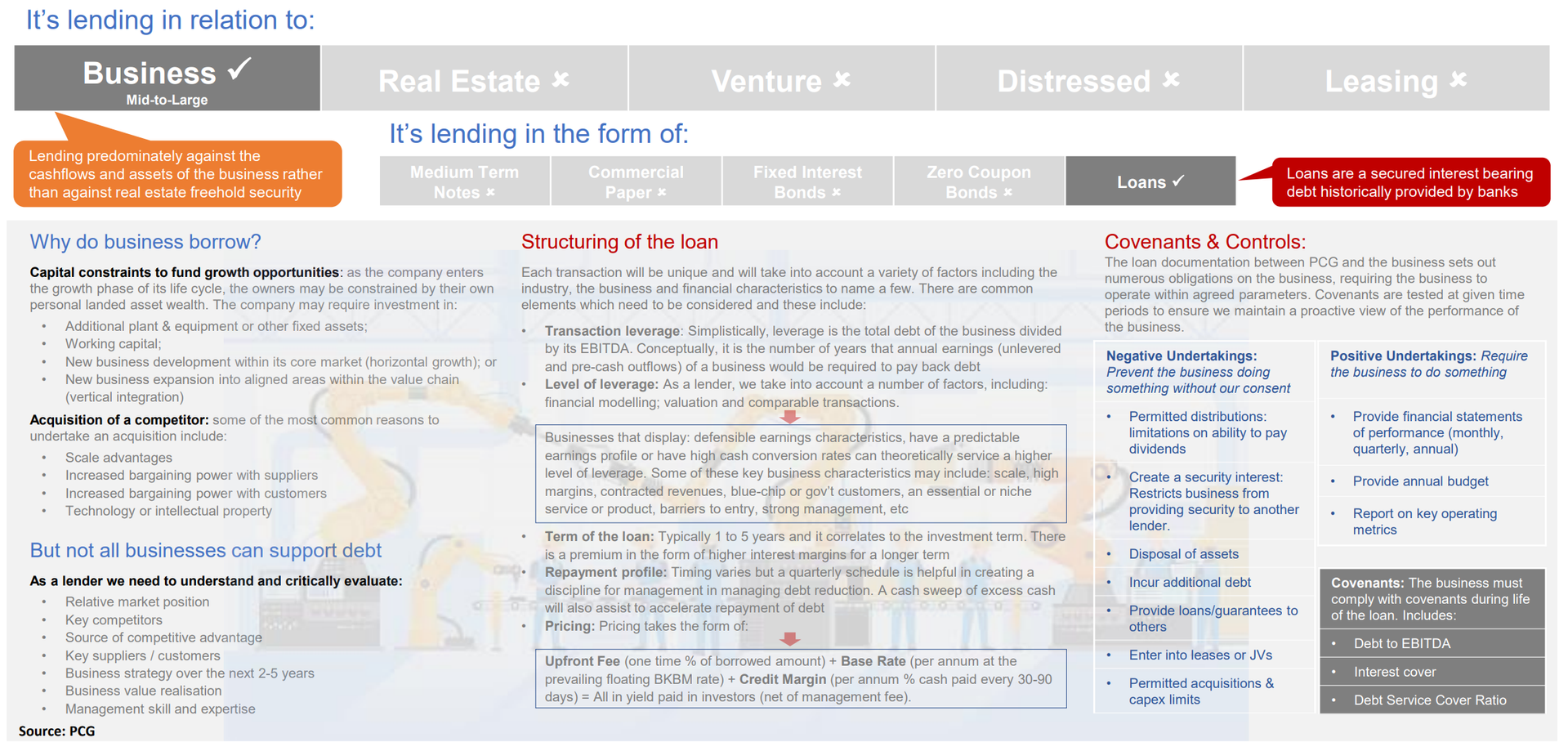

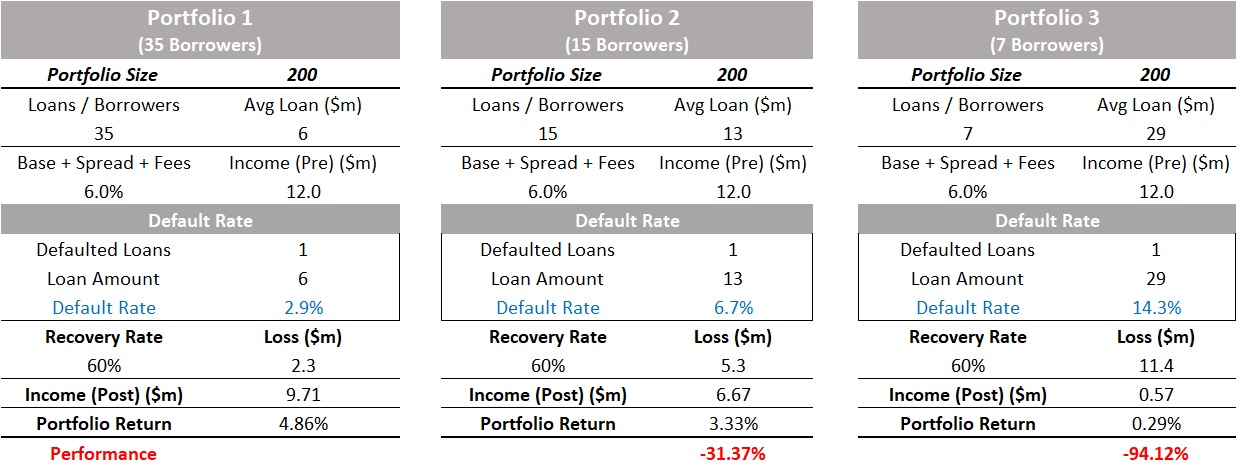

Private Capital Group generates favourable risk reward opportunities to meet the needs of Institutional, Iwi and High Net Worth investors. Our skilled team of credit specialists perform rigorous research and analysis in private markets to understand business drivers, opportunities and risks through proprietary due diligence. This approach to investment management provides investors with diversification and stable yield-oriented income over a long-term horizon.

Focus

We are the only independent private credit manager in New Zealand, with a focus solely on corporate private credit management. We ensure that any real or potential conflicts of interest are avoided through a dedicated credit management strategy which expressly precludes debt advisory or control equity activities.

Direct Lending

Kiwi Owned and Operated

We are 100% owned by our Executive, Board and Advisory Committee members.

Exclusively NZ

“We bring global expertise and a network of developed trusted relationships which helps to leverage our intellectual capital and local sourcing reach. This key differentiator creates long term partnerships with our investors and borrowers through the management and structuring of direct lending solutions”.

Paul Carman

Founder & Managing Partner

“We are thrilled to announce our partnership with PCG, aimed at offering valuable funding to growing New Zealand companies. We've been greatly impressed by the calibre of PCG's team and their unique positioning within the NZ market. We believe their capacity to provide vital funding to small businesses will not only enhance the returns of our KiwiSaver portfolios but also contribute significantly to the broader NZ economy”.

Sean Henaghan

Chief Investment Officer, Aurora Capital KiwiSaver

Insights & News